The Negative Impact of Working from Home on the Economy

By Faisale Shefawe

Published on 02/19/24 11:25 AM

Since the onset of the Covid-19 pandemic, there has been a significant shift in how people perceive traditional office work. Employees who adhere to a strict 5 or 4-day office schedule are increasingly seen as having undesirable jobs, with friends and family often advising them to seek fully remote positions. This transition towards remote work has empowered workers to choose comfort and flexibility, whether from the confines of their homes or even from scenic beach locales. The once-in-a-century transition, however, comes with its costs, particularly for the economy.

The primary industry likely to feel the adverse effects of the work-from-home (WFH) trend is regional banking. Bloomberg reports that regional banks have over $500 billion in exposure to Commercial Real Estate (CRE) loans, many of which are due within the next year. These banks now rely on the Federal Reserve to lower interest rates, enabling CRE lenders to refinance their loans. However, with the acceptance of remote work by many businesses, CRE investors have faced challenges in securing and retaining tenants over the past few years.

Signs of trouble are already evident. On January 31st, New York Bancorp announced a dividend cut and allocated significant reserves to cover expected losses from CRE loans. Following this news, Bancorp's stock plummeted by more than 30% after markets closed. This issue isn't confined to U.S. regional banks; Japanese bank Aozora saw a drop of over 20% after setting aside more than $200 million for bad CRE loans, prompting its former President's resignation announcement. Similarly, Deutsche Bank allocated $133 million for anticipated losses from U.S. CRE loans, citing challenges faced by CRE investors in refinancing loans due to low demand and high interest rates.

The impending storm in the CRE sector may extend to residential real estate. If regional banks write off significant portions of their CRE loans and office buildings are repurposed for multifamily dwellings or affordable housing, this shift could exert downward pressure on home values.

Regional banks play a crucial role in mortgage lending, providing loans to homebuyers and real estate developers. As these banks set aside funds to cover losses from CRE loans, the availability of funds for mortgage loans diminishes, leading to lower asking prices for homes. Home values are contingent on supply and demand dynamics; reduced options for buyers and high-interest rates may prompt buyers to postpone purchases until conditions improve.

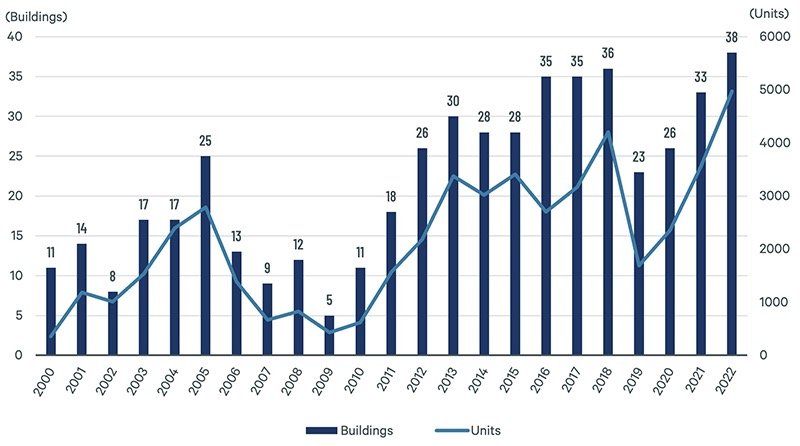

Another potential scenario impacting residential real estate involves the conversion of office buildings into multifamily or affordable housing. While this conversion has been relatively low due to high costs and regulatory hurdles, the landscape may change if numerous CRE investors default on loans, forcing banks to sell office buildings at reduced prices. This situation could prompt local governments to revise zoning laws to facilitate such conversions, further influencing home values.

Office to Multifamily Conversion Starts by Year

The surge in available housing, whether for sale or rent, can influence nationwide home values. Cheaper rents in major cities may deter individuals from purchasing homes until affordability improves, thereby affecting pricing strategies for home sellers.

The restaurant industry, particularly those establishments located near business centers, faces significant challenges due to the shift to remote work. Reports indicate that many restaurants in large cities are struggling to remain profitable as workers now visit offices only a few times a week. Job losses in this industry could ripple through the economy as affected workers seek alternative employment opportunities.

While working from home offers undeniable convenience, with no commute or dress code to worry about, this transition poses significant economic challenges. The economy must adapt to accommodate the growing preference for remote or hybrid work arrangements. However, this shift comes with costs for regional banks, homeowners, and those employed in the restaurant industry.